Understanding TDS: Rates, Filing Process, and TDS Returns

In the realm of taxation, Tax Deducted at Source (TDS) is a pivotal concept. It’s a mechanism devised by the government to collect taxes directly from the source of income. Having a grasp of TDS intricacies is vital for individuals and businesses alike to comply with tax laws. This detailed piece seeks to elucidate different facets of TDS, encompassing its definition, when it applies, the rates involved, exemptions available, and other pertinent aspects.

TDS Meaning

TDS, or Tax Deducted at Source, serves as a crucial tax collection tool for the government. When individuals or businesses earn income, the entity making the payment deducts a certain percentage as tax before providing the payment to the recipient. This deducted amount is then submitted to the government by the deductor. TDS applies to various types of income, including salaries, interest, dividends, rent, and commission. It ensures that taxes are collected promptly and accurately, facilitating smoother tax compliance and revenue generation for the government. Understanding TDS is essential for both payers and recipients to meet their tax obligations effectively.

Understanding TDS Rates

TDS rates vary based on income type and recipient status, outlined in the Income Tax Act, 1961. These rates are subject to periodic updates. Awareness of applicable rates ensures accurate tax deduction. Here’s an elaboration:

- Salary Income: Employers deduct TDS progressively, aligned with the employee’s income slab. For instance, if an employee falls in the 20% tax slab, TDS is deducted at a 20% rate from their salary.

- Interest Income: Banks deduct TDS at a 10% rate on interest income from fixed deposits or savings accounts, exceeding a specified threshold. Senior citizens enjoy a higher threshold, with TDS deducted only if interest income surpasses that limit.

- Rental Income: TDS applies when monthly rent crosses a set threshold, taxed at a 10% rate. However, recipients below the taxable limit can request non-deduction by submitting Form 15G or 15H to the deductor.

TDS Exemptions and Deductions

While TDS is widespread, certain exemptions and deductions can reduce its liability, aiding tax planning. Understanding these provisions is crucial for tax optimization. Here’s an elaboration:

Exemptions:

- Agricultural Income: Income from agriculture is exempt from TDS.

- Dividends: Dividends from domestic companies are TDS exempt.

- Capital Gains: Depending on the type and applicable exemptions, TDS may not apply to capital gains.

Deductions:

- Section 80C: Investments in specified avenues like provident funds and life insurance premiums qualify for deductions.

- Section 80D: Premiums paid towards health insurance policies are eligible for deductions under Section 80D.

- Section 80G: Donations to specified charitable institutions attract deductions under Section 80G.

What is a TDS return?

A TDS return serves as a formal declaration by the deductor regarding the tax amounts they have deducted at the source and subsequently deposited with the government. This return is a mandatory requirement specified under the Income Tax Act of 1961. When an entity or individual deducts TDS from payments made to others, such as salaries, interest, rent, or professional fees, they are obligated to file a TDS return.

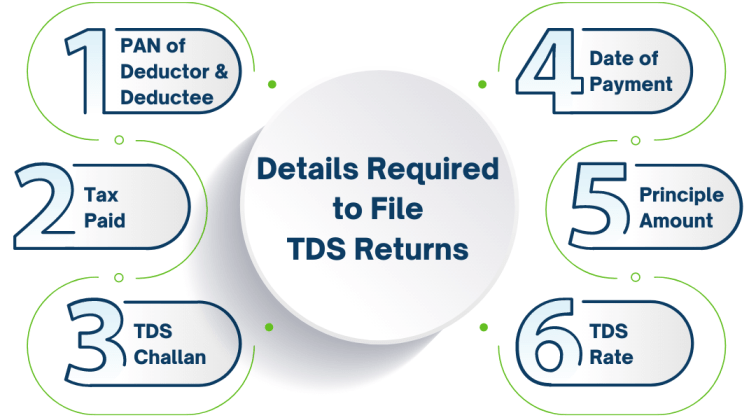

The return contains comprehensive details, including information about the deductor (the entity deducting the tax), the deductee (the recipient of the payment), the nature of the payment, the amount deducted, and other relevant particulars. By filing this return, the deductor essentially provides evidence of the TDS deducted and remitted to the government.

Filing a TDS return is vital for tax compliance purposes as it allows tax authorities to monitor and verify the accuracy of TDS deductions made by the deductor. It facilitates cross-verification of the TDS claimed by the deductor with the TDS amounts actually deposited with the government. This process ensures transparency and accountability in tax collection and helps prevent tax evasion.

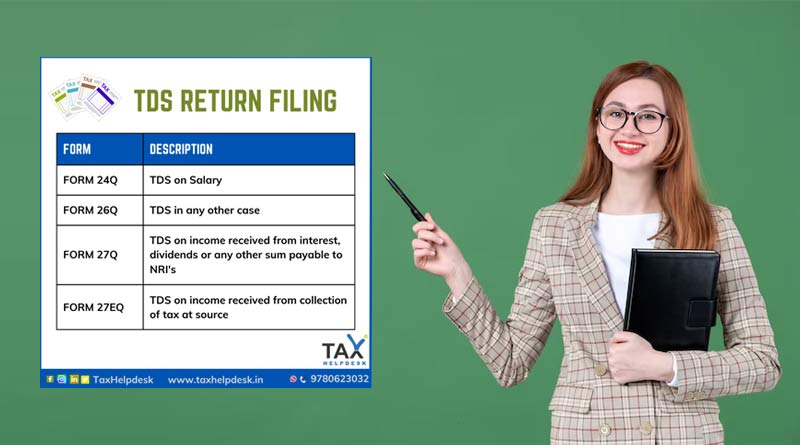

What is the return filing process for TDS?

The process of filing a TDS return involves several steps:

- Collecting TDS details: The deductor gathers all necessary information about TDS deducted from various payments made during a specific period.

- Preparing the TDS return: Using the appropriate form (e.g., Form 24Q for salary payments, Form 26Q for non-salary payments), the deductor fills out the TDS return with accurate details.

- Verification and validation: Before submission, the deductor verifies and validates the provided information, correcting any errors or discrepancies.

- Submitting the return: The completed TDS return is electronically submitted through the Tax Information Network (TIN) or the Income Tax Department’s e-Filing portal within the specified due date.

- Issuing TDS certificates: After filing the return, the deductor must issue TDS certificates to the deductees, containing details of the TDS deductions made.

It’s crucial to file TDS returns on time to avoid penalties and interest charges. Compliance ensures transparency and accountability in the tax deduction process.

Filing TDS returns is a vital aspect of tax compliance for deductors. By adhering to the prescribed process and timelines, they ensure transparency and accuracy in tax deduction and reporting. Timely submission helps avoid penalties and contributes to a smoother tax administration system. Like this post? Don’t forget to check out our other short stories in our Latest section