Guide to Form 26AS: Understanding Your Income Tax Statement

Form 26AS, known as the Tax Credit Statement, holds significant importance in tax filing processes. In the past, individuals had to download this form manually to file their income tax returns. However, its scope has broadened to encompass various financial transactions like foreign remittances, mutual fund purchases, dividends, and refund details. This consolidated document provides a comprehensive record of tax-related information associated with an individual’s PAN (Permanent Account Number). Accessible through the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website, Form 26AS helps individuals verify the accuracy of TDS certificates and ensures that the deducted tax amounts are correctly deposited with the income tax department.

Information Available on Form 26AS

Form 26AS is a comprehensive statement containing various tax-related details such as:

- Tax deducted from your income by all tax deductors.

- Tax collected at source by all tax collectors.

- Advance tax payments made by the taxpayer.

- Self-assessment tax payments.

- Regular assessment tax deposited by PAN holders.

- Details of income tax refunds received during the financial year.

- Information on high-value transactions like shares and mutual funds.

- Tax deducted on the sale of immovable property.

- Details of TDS defaults identified during the year.

- Turnover details reported in GSTR-3B.

Additionally, the new Annual Information Statement (AIS) introduced from June 1, 2020, includes information on specified financial transactions, pending and completed assessment proceedings, tax demands, refunds, and existing data from Form 26AS.

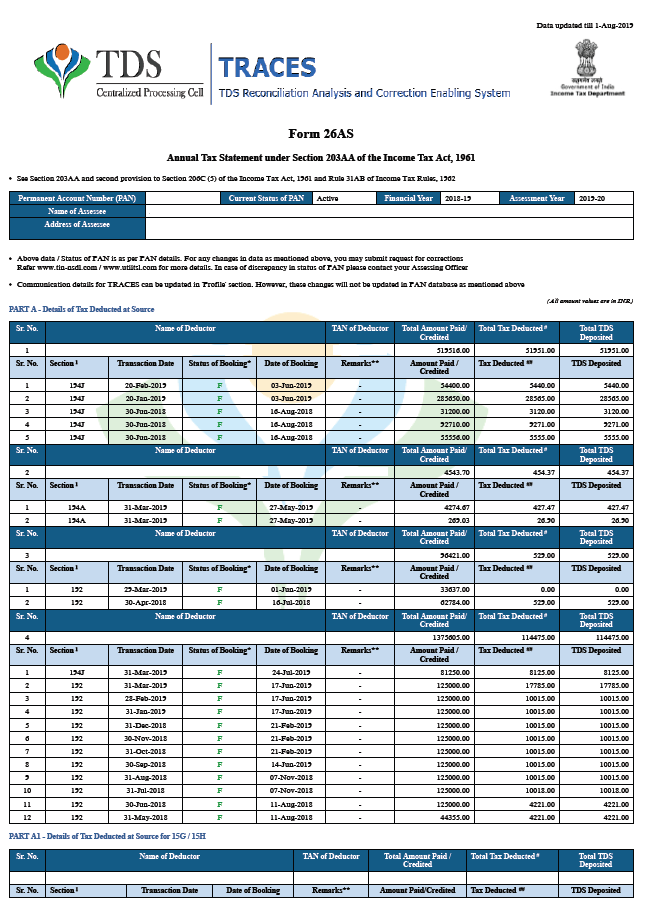

Structure and Parts of Form 26AS

Here’s a simplified breakdown of the different parts of Form 26AS:

- Part I: Details of Tax Deducted at Source (TDS) on income sources like salary, business, profession, and interest income.

- Part II: Details of TDS for cases where no TDS was made due to Form 15G/15H, mainly applicable for senior citizen taxpayers.

- Part III: Details of TDS made on payments made in kind, such as cars in lotteries or foreign trips for meeting sales targets.

- Part IV: Details of TDS made under various sections like 194IA, 194IB, 194M, and 194S, for transactions like sale of property, rent payment, contractor services, or sale of virtual digital assets (cryptocurrency).

- Part V: Details of transactions under specific provisions like section 194S, concerning sellers of virtual digital assets.

- Part VI: Details of Tax Collected at Source (TCS) made under various sections of 206C.

- Part VII: Details of paid refunds processed by the CPC TDS.

- Part VIII: Details of TDS made by the buyer or tenant of property, or by persons making payments to contractors or professionals, or buyers of virtual digital assets.

- Part IX: Details of transactions or demand payments concerning the purchase of virtual digital assets.

- Part X: TDS/TCS Defaults after processing of TDS returns, excluding demands raised by assessing officers.

How to view Form 26AS?

You can access Form 26AS through:

- The TRACES portal

- The net banking facility provided by your bank

How To Download Form 26AS From TRACES?

To download Form 26AS from the TRACES website, follow these steps:

- Visit the e-filing website.

- Enter your user ID, which can be your PAN or Aadhaar number.

- Enter the password and continue.

- Go to ‘e-file,’ then ‘Income Tax Returns,’ and select ‘View Form 26AS’ from the drop-down menu.

- Confirm the disclaimer to proceed to the TRACES website.

- Select the box on the TRACES website and click ‘Proceed.’

- Click the link to ‘View Tax Credit (Form 26AS).’

- Choose the Assessment Year and format (HTML for online viewing or PDF for download).

- Enter the verification code and click ‘View/Download.’

- After downloading, open the file to view Form 26AS.

TDS Certificate (Form 16/16A) and Form 26AS

Form 26AS and TDS certificates like Form 16/16A serve different purposes, despite containing similar information. While Form 26AS provides a consolidated view of TDS details for tax filing, obtaining a TDS certificate is essential for verification. Form 26AS enables taxpayers to cross-check and rectify any discrepancies, ensuring transparency. However, for salaried individuals, TDS certificates are necessary as they detail income break-up and deductions crucial for filing ITR, which Form 26AS may lack. Therefore, both Form 26AS and TDS certificates are necessary for accurate tax filing.

Form 26AS and TDS certificates are essential documents for tax compliance. While Form 26AS provides a comprehensive view of TDS details, TDS certificates offer specific income break-up crucial for filing ITR. Both documents play complementary roles in ensuring accurate tax filing and verifying financial details. Like this post? Don’t forget to check out our other short stories in our Latest section