The 5 Cs of Credit: Why They Matter

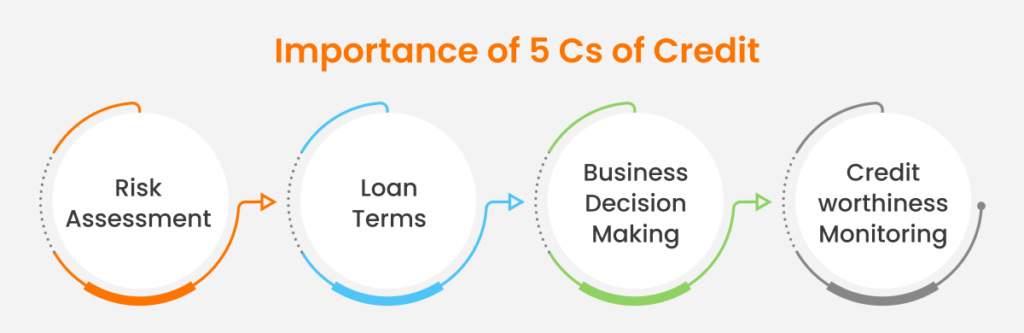

Understanding the 5 Cs of Credit is essential for anyone seeking loans or credit. These criteria—Character, Capacity, Capital, Collateral, and Conditions—play a crucial role in determining a borrower’s creditworthiness. By evaluating factors like payment history, income stability, and asset ownership, lenders assess the risk associated with extending credit. Whether applying for a mortgage, car loan, or credit card, knowing the 5 Cs can help individuals improve their chances of approval and secure favorable terms. Let’s delve into why these criteria matter and how they impact borrowing opportunities.

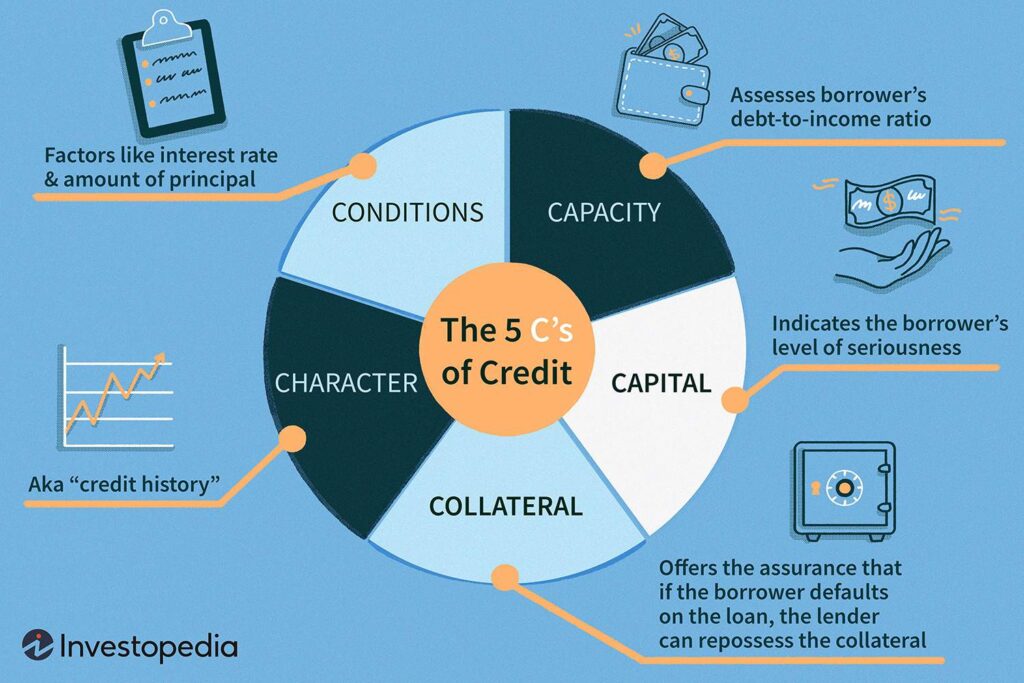

What Are the 5 Cs of Credit?

Lenders use the five Cs of credit to assess the reliability of borrowers. This system evaluates five aspects of the borrower and loan terms to predict the likelihood of default and potential financial risk for the lender. The five Cs include character, capacity, capital, collateral, and conditions. The five-Cs-of-credit method assesses borrowers using a mix of qualitative and quantitative measures. Lenders review credit reports, credit scores, income statements, and other financial documents. They also consider details about the loan. While each lender has its approach, most rely on the five Cs—character, capacity, capital, collateral, and conditions—when evaluating credit applications for individuals or businesses.

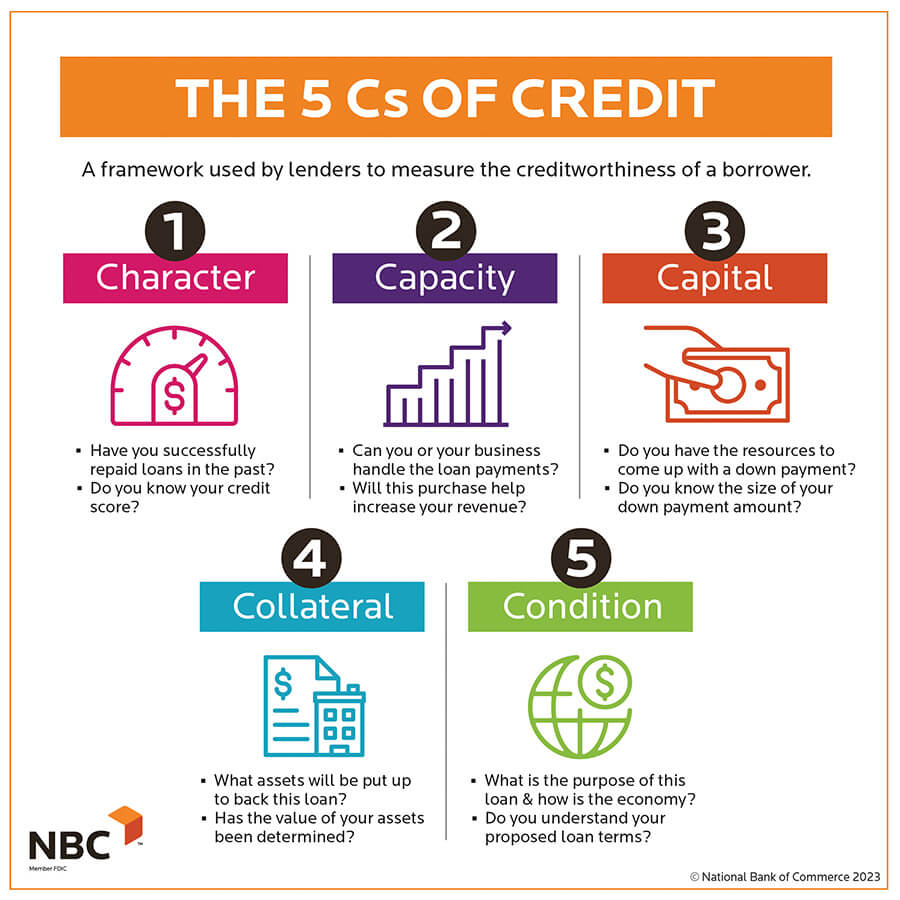

1. Character

Character, the initial C, specifically refers to credit history, indicating a borrower’s track record in repaying debts. Credit reports, generated by major bureaus like Equifax, Experian, and TransUnion, detail past borrowing and repayment behavior. They include data on timely payments, collection accounts, and bankruptcies, often retained for seven to 10 years. Lenders use this information to assess credit risk. For instance, FICO utilizes credit report data to generate credit scores, offering a quick overview of creditworthiness before delving into credit reports.

FICO Scores, ranging from 300 to 850, aid lenders in predicting a borrower’s likelihood of timely loan repayment. Additionally, firms like VantageScore, a collaboration of Equifax, Experian, and TransUnion, offer similar information to lenders. Lenders often impose minimum credit score requirements, varying across products and institutions. Higher credit scores generally increase approval chances. Credit scores also influence loan rates and terms, with better scores often yielding more favorable offers. Given the importance of credit scores and reports in loan approval, utilizing reputable credit monitoring services can help safeguard this critical information.

2. Capacity

Capacity evaluates a borrower’s ability to repay a loan by comparing their income to recurring debts and assessing the debt-to-income (DTI) ratio. Lenders compute DTI by dividing the borrower’s total monthly debt payments by their gross monthly income. A lower DTI increases the likelihood of loan approval. Mortgage lenders often prefer a DTI of 36% or lower, with some prohibited from lending to consumers with higher DTIs. For instance, qualifying for a mortgage typically requires a DTI of 43% or lower to ensure borrowers can comfortably manage monthly payments, as per the Consumer Financial Protection Bureau (CFPB).

3. Capital

Lenders also take into account any capital that borrowers invest in a potential venture. A substantial capital contribution reduces the risk of default. For instance, borrowers who can make a down payment on a home often find it easier to secure a mortgage, including specialized loans aimed at expanding homeownership opportunities. Loans guaranteed by the Federal Housing Administration (FHA) may require a down payment of 3.5% or more, while nearly 90% of Department of Veterans Affairs (VA)-backed home loans are granted without a down payment. Capital contributions demonstrate the borrower’s commitment, instilling confidence in lenders to extend credit. Moreover, the size of the down payment can impact loan rates and terms, with larger contributions typically resulting in more favorable terms. For example, a down payment of 20% or more on a mortgage loan may eliminate the need for additional private mortgage insurance (PMI).

4. Collateral

Collateral serves as security for loans, assuring lenders that if borrowers default, they can recoup losses by repossessing the collateral. Typically, the collateral is the item for which the money is borrowed—auto loans are secured by cars, while mortgages are secured by homes. These loans, often termed secured loans or secured debt, are viewed as less risky for lenders. Consequently, they typically come with lower interest rates and more favorable terms compared to unsecured financing options.

5. Conditions

Apart from assessing income, lenders also evaluate general loan conditions. This includes the duration of the applicant’s current job tenure, industry performance, and future job stability. Loan conditions, like interest rates and principal amounts, impact the lender’s willingness to provide financing. They also encompass how the borrower plans to utilize the funds. For example, business loans with potential future cash flow may have more favorable conditions than loans for home renovations in a sluggish housing market. Furthermore, lenders may consider external factors beyond the borrower’s control, such as economic conditions, industry trends, or impending legislative changes, when evaluating loan applications.

Before issuing debt, lenders assess borrowers using specific criteria, commonly known as the five Cs. These criteria encompass credit character, capacity to repay, collateral available, capital for upfront payments, and prevailing market conditions. By evaluating these factors, lenders can offer the most favorable credit terms to borrowers. Like this post? Don’t forget to check out our other short stories in our Latest section