Sovereign Gold Bonds: Essential Information for Potential Investors!

In India, gold holds special significance. People buy it not only for its value but also because it’s believed to bring good luck. They often purchase gold during important events or festivals as a way to celebrate and secure their wealth. Many Indians prefer to have physical gold in their possession, like jewelry or coins, because it feels more tangible and traditional. However, there’s another way to invest in gold without holding it physically: through Sovereign Gold Bonds. These bonds are like certificates issued by the Indian government and the Reserve Bank of India. When someone buys these bonds, they’re essentially investing in gold without needing to store it themselves. It’s a way to participate in the gold market without worrying about storing or securing physical gold. This option provides flexibility and convenience for those who prefer not to handle actual gold items.

What are Sovereign Gold Bonds?

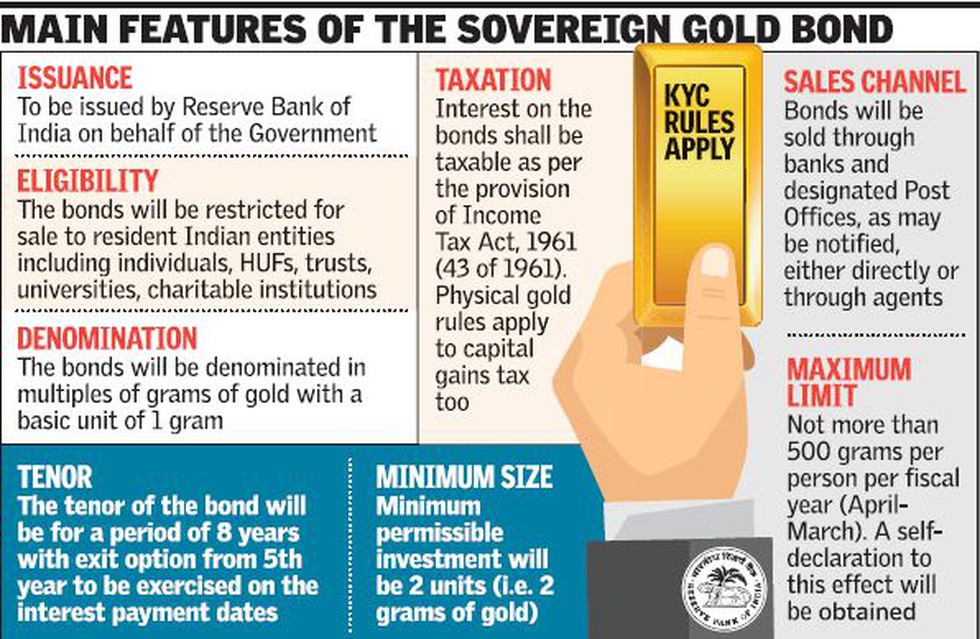

Sovereign Gold Bonds were introduced by the Government of India in November 2015 as an option for people who don’t want to buy physical gold. They’re like loans you give to the government and are considered part of Debt Funds. Instead of buying gold in the form of jewelry or coins, you buy these bonds, which represent a certain amount of gold in grams.

The government pays you interest on these bonds, which is currently set at 2.50% per year, paid twice a year. These bonds last for 8 years, but you can choose to exit early in the 5th, 6th, or 7th year. There are limits to how much gold you can buy through these bonds: 4 kgs for individuals and Hindu-Undivided Families (HUFs), and 20 kgs for trusts and similar groups. If you co-own the bonds, the 4 kg limit applies to the first person listed. When you buy these bonds, you get a certificate showing that you own them. It’s another way for people in India to invest in gold, which is seen as lucky and is often bought for special occasions.

Features and Benefits of Investing in Sovereign Gold Bonds

- Government Backing: The Sovereign Gold Bond (SGB) scheme is backed by the Government of India, giving investors confidence in their investment in gold.

- Fixed Tenure: SGBs have a set period, usually 5 to 8 years, helping investors plan for the long term.

- Traded on Exchanges: SGBs can be traded on recognized stock exchanges, offering liquidity for investors who want to buy or sell before the bond matures.

- Interest Income: Investors get a fixed interest rate on their initial investment plus any increase in the gold’s value during the bond’s term.

- Denomination Flexibility: SGBs come in different sizes, so investors can choose what fits their financial goals.

- Eligibility for Loans: SGB holders can use the bonds as collateral to get loans, giving them more financial options.

- Diversification: SGBs let investors spread their money across different types of investments, including gold, which is usually steady.

- No Storage Hassles: Unlike physical gold, SGBs don’t need special storage, making them easier to manage.

- Protection Against Gold Price Volatility: The fixed interest rate on SGBs helps shield investors from the ups and downs of gold prices, making it a safer investment.

- Safe and Transparent: Because they’re backed by the government, SGBs are seen as secure. Plus, their prices are tied to the real value of gold, so investors know they’re being treated fairly.

Process on investing in SGBs

Investing in Sovereign Gold Bonds (SGBs) is a great way to join the gold market while enjoying government support and fixed interest earnings. Here’s how you can invest in SGBs:

- Track SGB Issuance: Stay informed about when new SGB series are released by the government. They announce this periodically with specific terms and conditions.

- Choose an Authorized Intermediary: Find and approach authorized intermediaries for SGB investments. These can be commercial banks, designated post offices, or recognized stock exchanges.

- Complete Necessary Documentation: Make sure you have all the required documents ready, like ID proof and address proof, following the KYC norms set by the intermediaries.

- Application Process: Fill out the application form provided by the intermediary, including your desired investment amount and other details.

- Payment: Pay for the subscribed SGBs using a cheque, demand draft, or electronic transfer, based on the issue price at the time.

- Acknowledgment and Confirmation: After submitting your application and payment, you’ll get acknowledgment and confirmation from the intermediary.

- Allotment: Once the subscription period ends, the intermediary will confirm how many SGBs you’ve been allotted.

- Credit to Demat Account: If you have a demat account, your allotted SGBs will be credited directly. Make sure your account details are correct.

- Apply for Physical Certificates: If you prefer physical certificates, request them during the application. Note that this might take longer.

- Hold or Trade: Decide whether to keep your SGBs until maturity or trade them on recognized stock exchanges for liquidity.

- Interest Payments: Earn fixed interest payments at regular intervals, credited to your bank account.

- Redemption: When the bonds mature, you’ll get back the principal amount based on prevailing gold prices. You can also sell them before maturity on stock exchanges if needed.

Who can Invest in Sovereign Gold Bond Schemes?

Investing in SGBs lets individuals diversify their investment portfolio. Here’s who can invest in them:

- Indian Residents: People who live in India can invest in SGBs.

- Foreign Exchange Management Act (FEMA) Compliance: Those who meet the terms of the Foreign Exchange Management Act of 1999 are eligible to invest in SGBs.

- Trusts, HUFs, Charitable Institutions, and Universities: These entities can also invest in the gold bond scheme.

- Residents Changing to Non-Residents: Investors who change from resident to non-resident status can still hold onto their SGBs until they mature.

- Minors with Guardian Consent: Minors can invest in these bonds with their parents’ or guardians’ help.

How to Buy Sovereign Gold Bonds Online?

Here’s how you can purchase Sovereign Gold Bonds online:

- Log In: Log into your internet banking account with the specified bank.

- Navigate to e-Services: Look for the ‘e-service’ option and click on it.

- Select Sovereign Gold Bond: Find and select the ‘Sovereign Gold Bond’ option from the menu.

- Agree to Terms: Click on ‘Proceed’ after agreeing to the terms and conditions as per RBI guidelines.

- Fill Registration Form: Complete the registration form and click ‘Submit’.

- Have Aadhar and PAN Ready: Make sure you have your Aadhar and PAN card details handy.

- Enter Subscription Quantity: Input the quantity of bonds you want to subscribe for and provide nominee details if required.

- Review and Submit: Verify all the details you’ve entered, then click ‘Submit’ to complete the process.

Investing in Sovereign Gold Bonds online through internet banking offers convenience and accessibility. With simple steps and adherence to RBI guidelines, investors can diversify their portfolio and enjoy the benefits of government-backed gold investments seamlessly, making it an attractive option for many. Like this post? Don’t forget to check out our other short stories in our Latest section