Securing Your Retirement: Unlock the Benefits of NPS Contributions

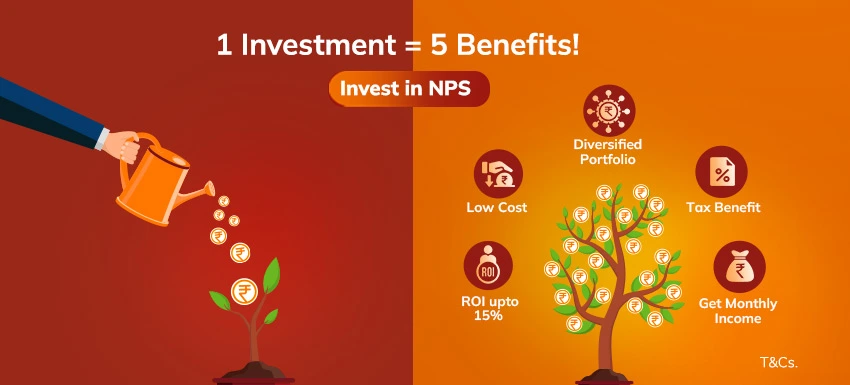

Retirement planning is a crucial aspect of financial stability, and the National Pension System (NPS) offers a strategic avenue for securing your future. NPS contributions provide a structured approach to building a retirement corpus, ensuring a comfortable post-retirement life. By understanding the benefits and intricacies of NPS, individuals can optimize their savings, enjoy tax advantages, and diversify their investment portfolios. This introduction sets the stage for delving deeper into how NPS contributions can empower individuals to take control of their retirement planning, making informed decisions to safeguard their financial well-being in the long term.

What is NPS Contribution?

The National Pension System (NPS) is like a savings plan for when you stop working. Anyone in India who is at least 18 years old, even if they live abroad, can put money into NPS. Employers can also add money to their employees’ NPS accounts, which is a common job benefit, especially in private companies and government jobs. With NPS, you save money regularly to build up a fund for when you retire. When you retire, you can take out some of the money as a lump sum, up to 60%, and use the rest to buy something called annuities. These annuities pay you a monthly amount after you retire, like a pension. How much money you have for retirement depends on how much you save, how long you save for, and how well your NPS investments do.

NPS Tier 1 & Tier 2 Contributions

NPS has two types of accounts: Tier 1 and Tier 2, each serving different purposes.

Tier 1 Contribution:

- Mandatory for all NPS subscribers.

- Requires a minimum initial contribution of Rs. 500.

- You need to contribute at least Rs. 1,000 annually to keep the account active.

- Contributions are locked until you reach 60.

- Offers tax benefits up to Rs. 2,00,000 per year.

Tier 2 Contribution:

- Voluntary account, but you must have a Tier 1 account.

- Minimum initial contribution is Rs. 1,000.

- You need to make at least one contribution per year to keep the account active.

- No lock-in period; you can withdraw anytime.

- Functions like a regular savings account, but no tax benefits.

How to Make NPS Contributions?

NPS contributions can be made both offline and online for Tier I and Tier II accounts.

Offline Contributions:

- Through Nodal Office: Visit the nearest Nodal Office, submit forms and documents, and they will upload your details to the NSDL CRA portal.

- Via PoP-SP: Approach a Point-of-Presence Service Provider (PoP-SP), submit an NPS Contribution Instruction Slip and necessary documents, and make contributions through cash, cheque, or DD.

Online Contributions:

- Through CRA Portals: Register with a Central Record Keeping Agency (CRA), receive PRAN details and passwords, and start investing in NPS Tier I and Tier II accounts.

- Via eNPS Portal: If NSDL is your CRA, log in with your PRAN and password, provide additional details, select account type and contribution amount, and make the payment.

- Using Mobile Apps: Download NSDL e-Gov or KFintech CRA apps, log in with PRAN details, and follow instructions to contribute. Available for Android and iOS users.

NPS Minimum Contributions

Here’s the minimum contribution required for both Tier I and Tier II accounts:

| Account Type | Minimum Contribution |

|---|---|

| Tier I | Rs. 500 initial, Rs. 1,000 annually thereafter |

| Tier II | Rs. 1,000 |

Remember, there’s no upper limit to contributions for either account type.

Employees can contribute to their NPS accounts through various methods, enjoying tax benefits along the way. Contributions to Tier I accounts are eligible for tax deductions of up to Rs. 2,00,000 per year. Here’s a breakdown of the tax benefits applicable to NPS contributions:

- Section 80CCD (1): Employees can claim tax deductions of up to 10% of their salary (basic and dearness allowance), capped at Rs. 1.5 lakhs annually.

- Section 80CCD (2): Employer contributions to NPS, up to 10% of salary (basic and dearness allowance), are also deductible. For government employees, the limit is 14% of salary.

- Section 80CCD (1B): Self-contributions of up to Rs. 50,000 can be claimed as an additional NPS tax deduction.

Contributions to Tier II accounts do not offer tax benefits. However, they are liquid, allowing withdrawals at any time as per the NPS withdrawal rules.

NPS offers a flexible and tax-efficient way to save for retirement, with contributions to Tier I accounts providing substantial tax benefits. Employees, whether salaried or self-employed, can maximize their retirement savings while enjoying tax advantages. Understanding the NPS tax deductions can empower individuals to secure their financial future effectively. Like this post? Don’t forget to check out our other travel tips and stories in our Latest section