How Much Health Insurance Do You Need?

It’s crucial to ensure that your family is adequately protected, especially when it comes to health. Health insurance plays a vital role in covering various medical expenses, including hospital stays, emergencies, and other healthcare needs. By having sufficient health insurance, you can safeguard your family’s financial well-being in times of medical crisis. This blog aims to guide you through determining the appropriate amount of health cover needed to provide comprehensive protection for you and your loved ones, offering peace of mind and security for the future.

How much health insurance do I need?

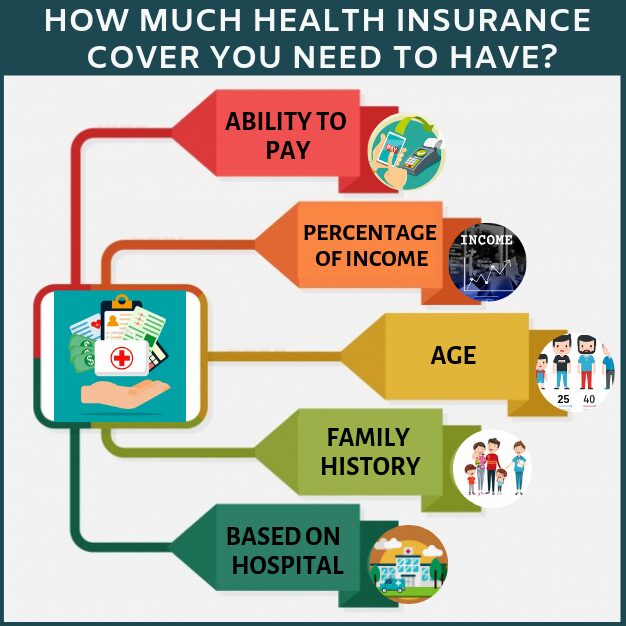

Choosing the appropriate health insurance plan can be daunting, but it’s crucial to customize it to your specific requirements. Medical expenses can vary, and what’s considered sufficient coverage now might not suffice in the future. Here are some pointers to assist you in determining the right plan:

- Understand Different Types of Health Insurance: Begin by familiarizing yourself with the various types of health insurance available, such as Individual, Family Floater, or Senior Citizen plans. Each type offers different levels of coverage and benefits, so it’s essential to choose one that aligns with your specific healthcare needs and financial situation.

- Consider Potential Medical Costs: Anticipate potential medical expenses for critical illnesses like kidney failure, heart disease, or cancer. It’s prudent to opt for a plan that covers such conditions adequately. Additionally, you may want to consider adding a critical illness plan to your base coverage for extra protection against unforeseen health issues.

- Confirm Hospital Network Coverage: Ensure that your preferred hospital is part of the insurer’s network to access cashless treatment. Knowing which hospitals are covered can help you make informed decisions about your healthcare options and ensure seamless access to medical services when needed.

- Assess Employer’s Group Insurance: If you have coverage through your employer’s group insurance policy, evaluate its scope and limitations. Understanding the extent of coverage provided by your employer can help you determine the additional coverage you may need through a personal health insurance plan.

- Consider Family Medical History: Take into account any hereditary conditions or medical history within your family when selecting coverage. This information can help you tailor your health insurance plan to address potential health risks and ensure adequate protection for you and your loved ones.

- Evaluate Lifestyle Factors: Lifestyle choices, such as diet, exercise habits, and stress levels, can significantly impact your health. Consider whether your health insurance plan covers lifestyle-related illnesses and conditions to ensure comprehensive coverage for any health issues that may arise.

- Age Considerations: Age plays a significant role in determining your coverage needs. Older adults may require more comprehensive coverage for age-related illnesses, while younger individuals may need less extensive coverage. Choose a plan that offers appropriate coverage based on your age and health status.

- Affordability: Balance the coverage you need with what you can afford. Opt for a health insurance plan with premiums that fit comfortably within your budget, ensuring that you can maintain coverage without financial strain.

- Tax Benefits: Explore the tax benefits offered by health insurance plans and choose one that helps you maximize your tax savings while providing the coverage you need. Consider factors such as premium payments and tax deductions when selecting a plan.

- Coverage for High-Cost Treatments: Ensure that your health insurance plan provides adequate coverage for high-cost treatments, such as surgeries or specialized medical procedures. Having comprehensive coverage for these expenses can offer financial protection and peace of mind during challenging times.

Minimum health insurance coverage

A helpful guideline is to aim for health insurance coverage equivalent to around 50% of your yearly income. For instance, if you earn Rs. 20 lakhs annually, a Rs. 10 lakhs health insurance policy could suit your needs. Nonetheless, it’s advisable to opt for a minimum coverage of Rs. 5 lakhs due to the escalating healthcare expenses.

Securing adequate health insurance coverage is crucial to safeguarding yourself and your loved ones from unforeseen medical expenses. By carefully assessing your healthcare needs, considering potential future costs, and selecting a suitable plan, you can attain peace of mind knowing that you are financially protected against health-related emergencies. Like this post? Don’t forget to check out our other short stories in our Latest section