Comprehensive Guide for Small Cap Investments

Investing in stocks can be exciting but tricky. Small companies, known as small-cap stocks, offer a different opportunity than big ones. Recently, small companies in the UK, Europe, and the US faced some difficulties compared to big ones. But this could mean a chance for investors. In this guide, we’ll talk about why, what, and how to invest in small-cap stocks. We’ll give you tips, strategies, and things to think about if you want to add them to your investments.

Why invest in small-caps?

Despite recent setbacks, small-cap stocks have a history of performing well over the long term. For example, the MSCI World Small Cap index has averaged an 8.78% yearly return since 2000, surpassing the 6.87% return of the MSCI All Companies World Index, which includes tech giants like Meta and Apple.

Though small-cap stocks can be volatile, they offer significant growth potential in bullish markets. Several factors suggest a potential upswing in small-cap performance in 2024. These include stabilized interest rates, increased merger activity, and attractive valuations. The recent market rally, prompted by hints of interest rate cuts from the Federal Reserve, highlights the influence of interest rates on small-cap stocks.

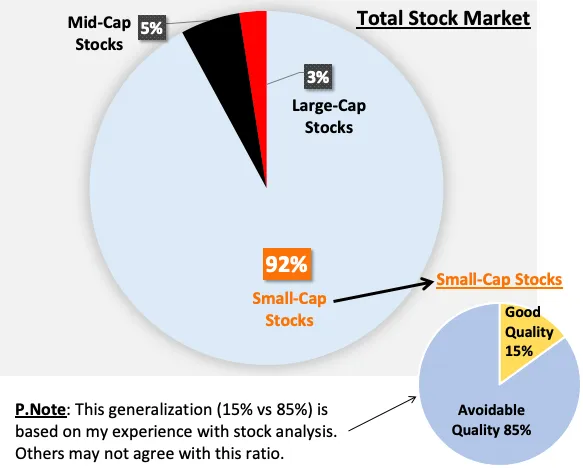

Understanding small-cap stocks

Small-cap stocks represent shares of smaller companies, typically valued from a few hundred million to a few billion dollars, depending on where they operate. While often overlooked, they can offer investors opportunities for significant profit growth. However, they also pose higher risks due to their volatility. It’s important to note that small-caps differ by region. UK small-caps, for instance, have faced challenges like Brexit fallout and economic weaknesses, while North American small companies have thrived amidst a strong US market and GDP growth. Investors should consider these regional differences when contemplating small-cap investments.

Strategies for successful small-cap investing

Diversification is key when investing in small-cap stocks. Spread investments across various company sizes, regions, and sectors to reduce risks. Global smaller companies funds like abrdn Global Smaller Companies offer diversification across regions and industries, lessening the impact of market fluctuations.

Building a small-cap portfolio involves aligning with your risk tolerance and investment goals. Identify whether you seek long-term growth, income, or both, and allocate your portfolio accordingly. Consider specific small-cap funds like Unicorn UK Smaller Companies for UK exposure or T. Rowe Price US Smaller Companies for US opportunities. Janus Henderson European Smaller Companies is ideal for European market exposure. When investing in small-caps, factors to consider include company fundamentals, growth potential, industry trends, and overall market conditions. Conduct thorough research and consult with financial experts to make informed decisions.

Factors to consider when investing in small-caps

- Valuations: Small-cap stocks, especially in the UK, often trade at appealing valuations compared to their historical averages, even after recent rallies. Analyzing valuation metrics and comparing them to historical norms and industry peers can help investors identify opportunities for potential share price re-rating.

- erger and Acquisition Activity: Increasing merger and acquisition (M&A) activity is a positive sign for small-cap stocks. Private equity firms and corporate rivals are taking advantage of low valuations to acquire small-cap businesses. Fund managers monitor M&A trends within the small-cap space to assess potential impacts on their portfolios, as companies involved in M&A may see significant share price increases.

Potential Pitfalls and Mitigation Strategies:

- Risks of Rising Borrowing Costs: Rising interest rates can increase debt-servicing expenses for small-cap companies, affecting their profitability and stock prices. Managers mitigate this risk by favoring companies with manageable debt levels and strong balance sheets. Monitoring macroeconomic conditions and central bank policies is essential to anticipate interest rate changes’ impact on small-cap performance.

- Economic Volatility: During economic uncertainty, small-cap companies may face challenges such as slow growth or weak business models. Active managers conduct thorough research on operational performance and financial health to focus on companies with resilient business models and growth prospects.

- Liquidity Concerns: Small-cap stocks may have lower liquidity due to their smaller market capitalization, leading to difficulties in buying or selling shares at desired prices. Investors should consider the trading volumes and average daily liquidity of small-cap funds to mitigate liquidity concerns. Understanding and navigating liquidity challenges are crucial for a smooth investment experience despite the exciting growth potential of small-cap stocks.

Opportunities in 2024

In 2024, small-cap investors may find promising opportunities despite recent challenges:

- Stabilization of Interest Rates: With interest rates becoming more predictable, investor confidence in small-cap stocks is rising. This stability bodes well for smaller companies, contributing to their outperformance compared to larger counterparts.

- Merger and Acquisition Activity: Increased M&A activity, especially in regions like the UK, Europe, and the US, is driving market growth. Private equity firms and corporate buyers are capitalizing on low valuations, often leading to share price increases for small-cap companies involved in these deals.

- Attractive Valuations: Despite recent market rallies, small-cap companies, particularly in the UK, still trade at appealing valuations. Many are priced below their historical averages, presenting an opportunity for investors as these companies return to normalized valuations, potentially leading to share price appreciation.

Best performing Elite Rated small-cap funds

| Rank | Fund/Trust Name | Sector | Percentage returns over 10 years** |

| 1 | Janus Henderson European Smaller Companies | IA European Smaller Companies | 184.96% |

| 2 | Liontrust UK Smaller Companies | IA UK Smaller Companies | 134.14% |

| 3 | WS Amati UK Listed Smaller Companies | IA UK Smaller Companies | 100.87% |

| 4 | Baillie Gifford Shin Nippon | IT Japanese Smaller Companies | 93.77% |

| 5 | The Global Smaller Companies Trust | IT Global Smaller Companies | 92.85% |

Despite challenges, 2024 presents potential for small-cap investors. Stable interest rates, rising M&A activity, and attractive valuations offer opportunities. With careful analysis and diversification, investors can navigate risks and capitalize on the growth potential of smaller companies. Like this post? Don’t forget to check out our other short stories in our Latest section