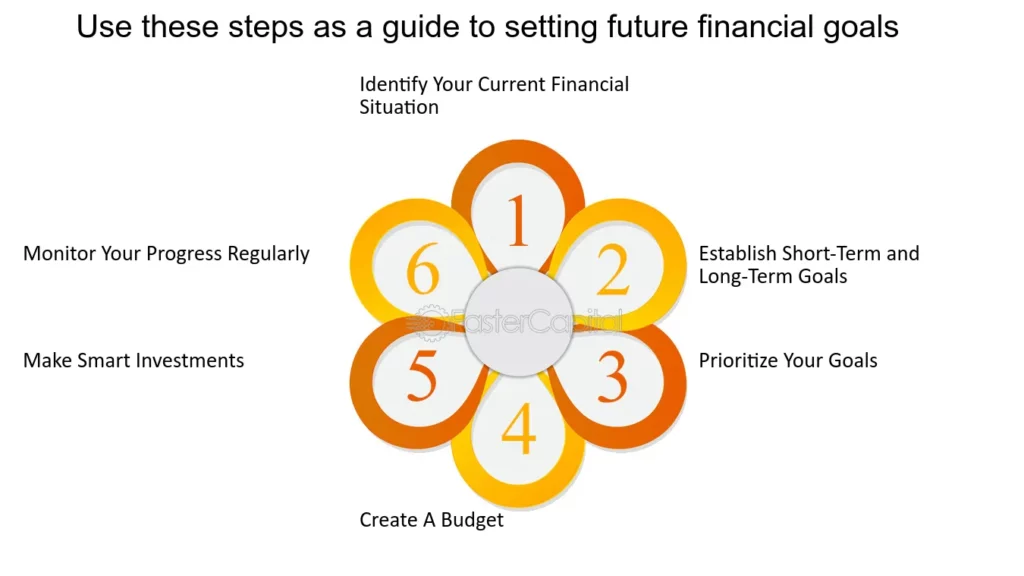

A Guide To Setting Financial Goals for Your Future

Setting financial goals, whether short-term, mid-term, or long-term, is vital for financial security. Without specific goals, overspending is likely, leading to financial stress when unexpected expenses arise or retirement looms. Planning ahead helps anticipate and prepare for potential crises, such as the recent pandemic, enabling proactive financial management. It’s an ongoing process, allowing adjustments to align with life changes. Thinking ahead empowers individuals to navigate uncertainties and mitigate risks, ensuring financial stability and peace of mind in the face of life’s challenges.

Short-Term Financial Goals

Setting short-term financial goals is essential for building a strong financial foundation and boosting confidence in achieving bigger, long-term objectives. These initial steps, achievable within a year, include creating a budget, establishing an emergency fund, and paying off credit card debt.

- Establishing a Budget: Understanding your current financial situation is crucial for effective planning. Utilize budgeting tools like Mint to track expenses and identify areas for potential savings. By analyzing spending habits, you can make informed decisions about allocating funds and prioritize expenses based on personal values.

- Creating an Emergency Fund: An emergency fund acts as a financial safety net for unexpected expenses. Start with a goal of $500 to $1,000 and gradually increase it to cover three to six months’ worth of living expenses. Consider automating monthly contributions to your emergency fund and supplementing savings through decluttering and selling items.

- Paying Off Credit Cards: Addressing credit card debt is vital due to its high-interest rates, which can impede progress towards other financial goals. Choose a repayment strategy that aligns with your preferences, whether it’s the debt avalanche or debt snowball method, and focus on eliminating high-interest debts first.

- Midterm Financial Goals: Once you’ve tackled short-term objectives, shift your focus to midterm financial goals that bridge the gap between short and long-term aspirations.

- Obtaining Life and Disability Insurance: Protecting your income and providing for dependents in the event of unforeseen circumstances is paramount. Secure term life insurance to support loved ones financially in case of your untimely demise, and consider disability insurance to safeguard against loss of income due to illness or injury.

- Paying Off Student Loans: Student loan payments can burden monthly budgets, hindering progress towards other financial milestones. Explore refinancing options for lower interest rates and utilize repayment strategies like the debt avalanche or snowball method to accelerate debt repayment.

- Pursuing Dreams and Aspirations: Midterm goals encompass a range of aspirations, from homeownership and renovations to saving for college expenses or starting a family. Define clear objectives and calculate savings targets to progress towards realizing your dreams.

Long-Term Financial Goals

Saving for retirement is a primary long-term financial goal for many individuals. A general guideline suggests setting aside 10% to 15% of income into retirement accounts like a 401(k) or IRA. To ensure adequate retirement savings, it’s essential to calculate your retirement needs accurately.

- Estimate Retirement Needs: Begin by estimating your desired annual retirement expenses, accounting for potential healthcare costs. Deduct expected retirement income sources, including Social Security and pensions, to determine the amount to be funded through investments.

- Calculate Required Retirement Assets: Utilize online retirement calculators to assess the necessary retirement assets based on current savings and annual contributions. A sustainable withdrawal rate, typically around 4%, helps gauge if your portfolio can sustain desired expenses throughout retirement.

- Example Calculation: Consider a 56-year-old couple aiming to retire in a decade. After accounting for Social Security benefits, determine the remaining investment needs. Calculate the total investments required to cover these needs at a sustainable withdrawal rate.

- Boost Retirement Savings: Maximize retirement contributions, particularly if your employer offers a matching program, as it provides a significant return on investment. Take advantage of IRA contributions at the beginning of the year to maximize growth potential.

Planning for retirement is crucial for financial security. By setting clear long-term goals, estimating retirement needs accurately, and maximizing contributions, individuals can work towards a comfortable retirement. Consistent saving efforts and strategic investment decisions are key to achieving financial independence and enjoying a worry-free retirement journey. Like this post? Don’t forget to check out our other short stories in our Latest section